are electric cars tax deductible uk

Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances. Vehicles are exempt if the following apply.

The Uptake Of Plug In Hybrid Electric Vehicles In Europe S Company Car Fleets Trends And Policies International Council On Clean Transportation

They have a maximum speed of 8mph on the road.

. Heres an example of the tax savings you can make by leasing. You will have to choose between taking a deduction for sales tax or for your state and local income tax. In 2020-21 the electric van was taxed at 80 of the benefit.

For tax year 202122 this increased to 1 and then increases. For tax year 202021 the percentage used to calculate the benefit on fully electric cars with zero emissions was 0. 4 Self-Employment Tax Deductions.

Are electric cars tax deductible UK. This means with electric cars you can deduct. Find out whether you or your employee need to pay tax or National Insurance for charging an electric car.

5 Is it true that. This means with electric cars you can deduct the full cost from your pre-tax profits. 43 Simplified method.

Are vehicle taxes deductible. Buying a car through your business example. Are electric cars fully tax deductible UK.

One area generating or perhaps we should say sparking lots of interest is the provision of electric vehicles EVs as company cars. Are Electric Vehicles Tax Deductible. You can deduct sales tax on a.

41 What is considered business travel. You deduct the cost against profits. Financial Year 202122 sees pure-electric models rated at 1 for BIK and these rates only climb to 2 for FY 2223 and 2324.

Are electric cars 100 tax deductible UK. Electric car owners may face taxes within three years. A Tesla car with zero emissions is exempt from vehicle excise duty.

Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances. This means with electric cars you can. The taxable benefit for having the private use of a zero-emission van was reduced to zero in April 2021.

The relevant BIK percentage is applied to the list price of the car which must include the cost of the battery even when this is leased separately by the business. Chancellor Jeremy Hunt has revealed drivers of electric cars and vans are likely to have to start paying road tax bills before 2025. You can also check if your employee is eligible for tax relief.

You lease an electric car for 6000 over the 2022-23 financial year. 3 Reclaiming Value Added Tax on a Car Subscription. From April 2020 to March 31 2025.

If the car is a hybrid. As a higher rate taxpayer you buy a 50k VAT car through your business and you will be using it 5050 for business and personal. For the 202223 tax year the amount of tax you pay in each band is being increased the implications for electric cars is that you will pay 2 per cent tax rather than 1 per cent.

9to5Toys - Seth Weintraub 1d. Do Teslas Pay Road Tax Uk. For the 202122 tax year where the car is 100 electric the BiK charge is just 1 of the list price of the car.

The tax and wider cost benefits of EVs. This electric car tax relief is potentially a big saving for employees making. This means with electric cars you can deduct.

Amazon offers the Mongoose Dolomite Mens Fat Tire Mountain Bike with 26-Inch wheels 4-Inch wide knobby tires 7-speed Shimano gears and. Cars with CO2 emissions of less than 50gkm are. Are electric cars tax deductible UK.

Electric vehicle owners currently dont pay the. Capital allowances on electric carsCars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances. A Whitehall source claimed it is now inevitable that electric vehicles will be subject to road tax at some point.

Mobility vehicles and powered wheelchairs. As such company car drivers can save thousands of pounds a. Cars with CO2 emissions of less than 50gkm are also eligible for 100 first year capital allowances.

They are fitted with a device that limits them to 4mph. Capital allowances on electric cars.

Electric Cars For Dentists Are Almost Tax Free With Their Own Company

How To Drive Electric Vehicle Uptake In Your City

Which Electric Cars Are Still Eligible For The 7 500 Federal Tax Credit News Cars Com

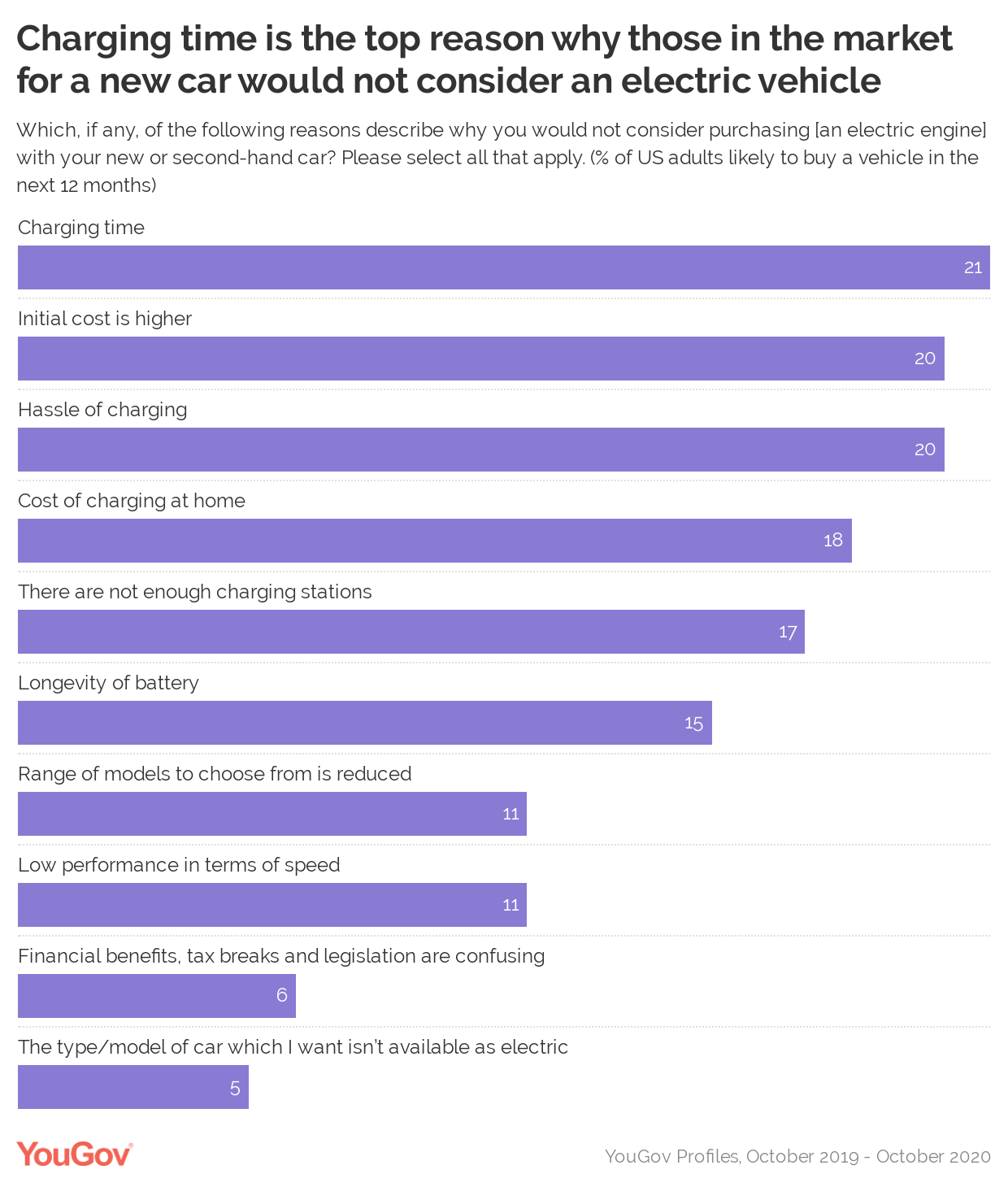

What S Stopping Americans From Buying Electric Cars Yougov

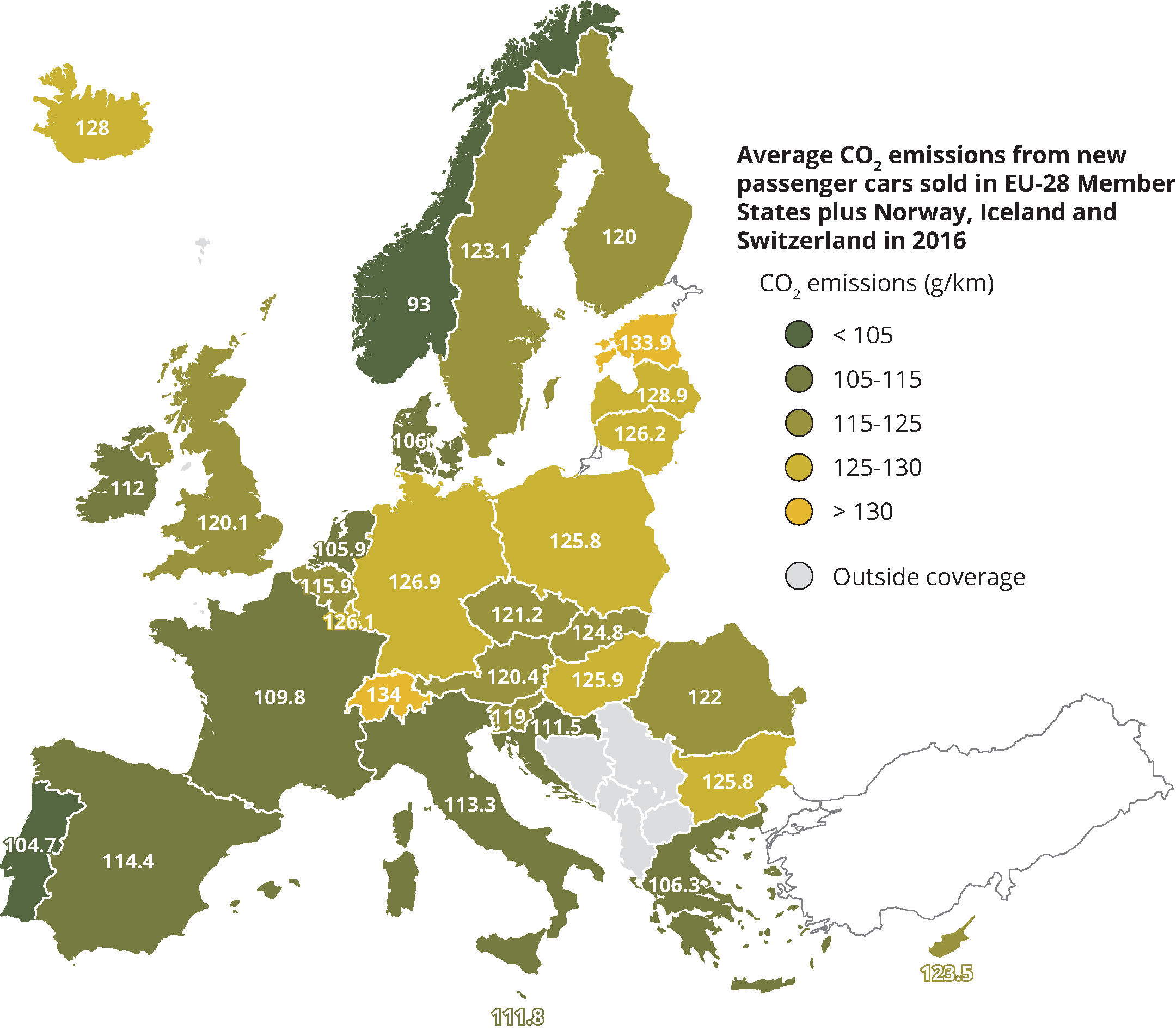

Tax Breaks And Incentives Make Europeans Buy Cleaner Cars European Environment Agency

Electric Vehicles Analysis Iea

A Complete Guide To Ev Ev Charging Incentives In The Uk

Overview Electric Vehicles Tax Benefits Purchase Incentives In The European Union 2021 Acea European Automobile Manufacturers Association

3 Electric Car Incentives You Need To Know In Europe

Electric Vehicle Credits Just Completely Changed Here S What It Means For Car Buyers Cnn Business

Car Owners Converting Vehicles To Electric Missing Out On Green Tax Breaks

What To Know About The Electric Vehicle Tax Credits And How To Get More Money Back Wsj

Road Tax Company Tax Benefits On Electric Cars Edf

Florida Family Drives Into Electric Car Problem A Replacement Battery Costs More Than Vehicle Itself Fox Business

Opinion Iea Head Electric Cars Are Transforming The Auto Industry That S Good News For The Climate Cnn Business

These Countries Offer The Best Electric Car Incentives To Boost Sales World Economic Forum

Tax On Company Cars Does It Pay To Go Electric Rouse Partners Award Winning Chartered Accountants In Buckinghamshire